CSG: Exclusion of foreign employees who are not tax resident in Mauritius

Article Published on April 21, 2021

The Contribution Sociale Généralisée (Amendment) Regulations 2021 (referred hereinafter as the “Regulations") was gazetted

earlier this month to amend the Contribution Sociale Généralisée (CSG) framework.

The main change brought in by the Regulations is the exclusion of non-citizens employees, who are not tax resident in Mauritius in line with the definition provided by the Income Tax Act 1995 (ITA), from the CSG framework i.e. employees falling in this specific category are not required to contribute CSG. This amendment is retrospective and is deemed to come into effect as from 1 September 2020, which coincides with the date on which the CSG was introduced.

Under the ITA, an individual is considered to be tax resident in Mauritius if he/she:

i. has his domicile in Mauritius unless his permanent place of abode is outside Mauritius;

ii. has been present in Mauritius in that income year, for a period of, or an aggregate period of, 183 days or more; or

iii. has been present in Mauritius in that income year and the 2 preceding income years, for an aggregate period of 270 days

or more

Mauritian companies employing foreign nationals have to monitor the tax residency status of these foreign nationals and make the

relevant salary adjustments, wherever applicable.

What is the CSG?

It will be recalled that the CSG was a measure stemming from the National Budget 2020/2021 and was introduced as from 1

September 2020 to replace the National Pension Fund (NPF). Contrary to the NPF, the CSG is an uncapped contribution and it

aims to aid the low earning, including self-employed individuals as well as Small and Medium Enterprises (SMEs).

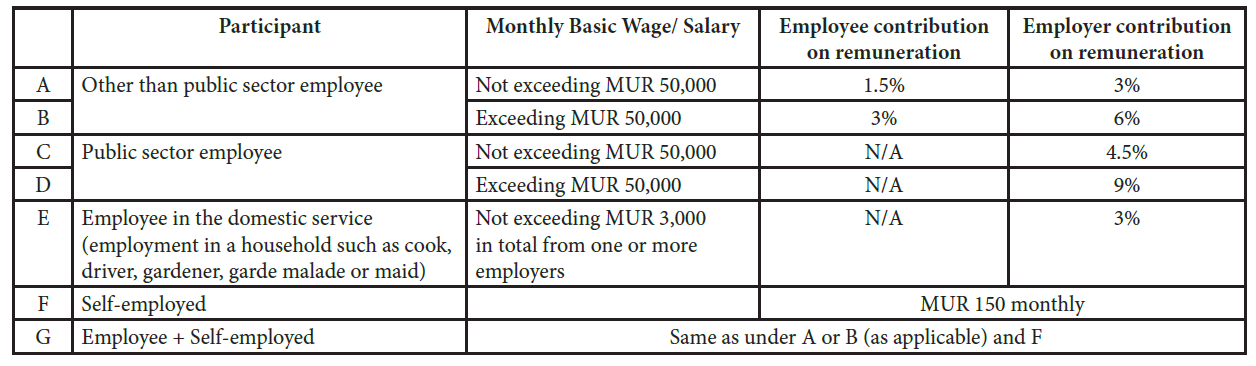

The MRA is the responsible body for the collection of the CSG. The rate of contribution is as follows:

The deadline for effecting CSG payment electronically to the MRA is the last day of the month following the end of the month for which payment was due failing which a penalty of 10% and an interest of 1% per month/part of a month is applicable.

How can ITL assist?

ITL has a specialized tax team who can assist on any queries relating to the CSG and other tax related matters. For any information or clarification, please write to your usual contact person at ITL or simply drop us an e-mail on info@intercontinentaltrust.com