FSC issues regulations for Peer-to-Peer lending

Article Published on October 19, 2020

The Financial Services Commission (FSC) issued the Financial Services (Peer to Peer Lending) Rules 2020 on 31 August 2020 (Referred hereinafter as the “Rules") which apply to Peer to Peer (P2P) Operators licensed by the FSC.

The Rules have come into operation on 15 August 2020.

Any person(s) carrying out P2P Lending or any other similar activity under a Regulatory Sandbox Licence issued by the Economic Development Board need to apply for a Peer to Peer Lending Licence within 3 months of the commencement of the Rules i.e. by 15 November 2020.

The main highlights of the Rules are as follows:

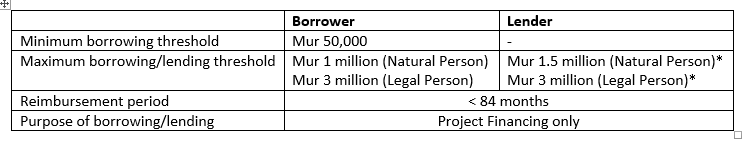

Limit on P2P Lending:

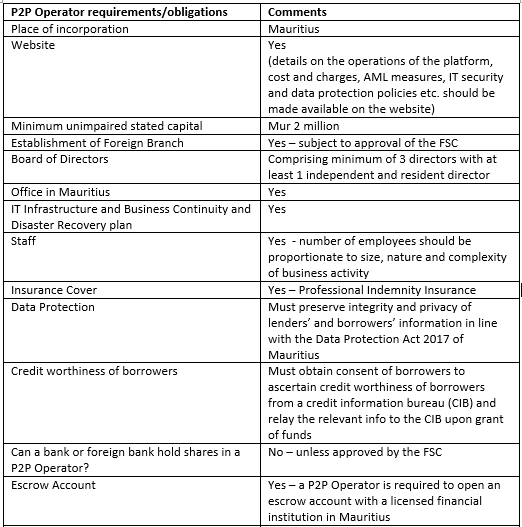

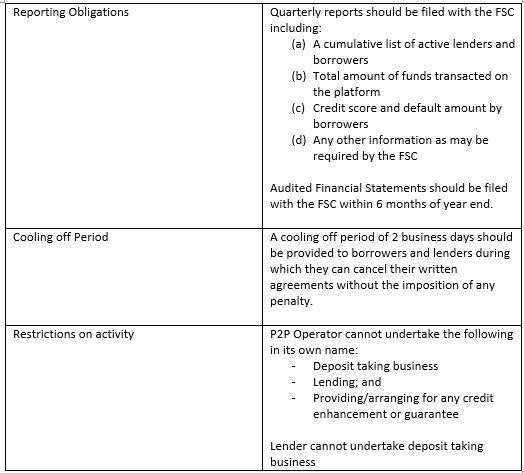

Main features of a P2P Operator:

* Lending limits do not apply to sophisticated investors lending in foreign currency through P2P Operators to borrowers based outside of Mauritius.

Under the Income Tax Act 1995, there are a few tax incentives that are available to P2P Lenders and Operators as follows:

- Interest derived from P2P lending benefits from a tax exemption of 80%

- Income derived by a P2P Operator benefits from a tax holiday of 5 years from the income year in which he starts operations provided that:

(i) Operations start before 31 December 2020;

(ii) The income derived is covered under the FSC licence;

(iii) The Operator satisfies the substance requirements of the FSC.

For more information on how we can assist, please get in touch with your usual person at ITL or write to us on info@intercontinentaltrust.com