Tax Transparency in Africa 2020: Mauritius a transparent jurisdiction

Article Published on August 7, 2020

The Tax Transparency in Africa 2020 report (the “Report"), a joint publication by the Global Forum on Transparency and Exchange of Information for Tax Purposes (Global Forum), the African Union Commission and the African Tax Administration Forum, was released in June 2020. The Report provides a detailed account of the progress achieved by the Africa Initiative(1) in 2019 in terms of global tax transparency and exchange of information in Africa – both having been recognized worldwide as effective tools for combatting illicit fund flows. It is estimated that illicit fund flows (IFFs) in Africa could amount to anything between USD 50 and 80 billion annually. IFFs impede effective Domestic Resource Mobilisation and it is estimated that every year, Africa loses USD 40 – USD 80 billion in tax evasion - which is incredibly high considering that most African countries generate GDP(2) of less than USD80 billion annually.

According to the Report, significant progress has been achieved on two pillars of the Africa Initiative as follows: (i) raising political awareness and commitment in Africa and (ii) developing capacities in African countries in tax transparency and exchange of information.

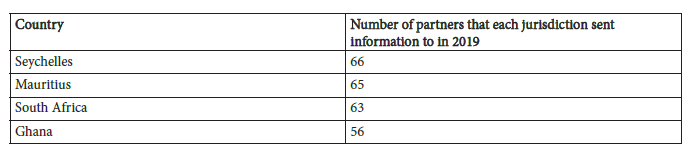

In 2019, 3 additional African Countries namely Guinea, Mali and Namibia joined the Global Forum and are thus new adherents of the Africa Initiative. The number of exchange of information requests also spiked by 48% in the same year compared to 2018 which translated into increased tax revenue – in 2019, 5 African countries recouped nearly USD12 million as additional tax revenue whilst the cumulative tax revenue received by 8 African countries since the start of the Africa Initiative in 2014 amounts to nearly USD189 million. The Report also highlights that 74% of the outgoing exchange of information requests made since 2014 emanated from 4 African countries as tabled below:

According to the Report, Mauritius was found to be compliant in the second round of the Exchange of Information on Request (EOIR) Reviews in 2017 which is a marked progression since the first round of review completed in 2014 when it was found to be largely compliant. The Report also highlights that Mauritius has adequate EOI Infrastructure in place as well as a clear strategy to integrate EOI in tax audits and investigations. It was also found to have confidentiality and data safeguards framework aligned to the Automatic Exchange of Information (AEOI) standard.

To access the full Report, please click Here

(1) About the Africa Initiative: The Africa Initiative was launched as a partnership between the Global Forum, its African members and a number of regional and international organisations and development partners: African Tax Administration Forum, Cercle de Réflexion et d’Echange des Dirigeants des Administrations Fiscales, World Bank Group, France (Ministry of Europe and Foreign Affairs) and the United Kingdom (Department for International Development). Initially set up for a period of three years (2015-2017), the Africa Initiative was renewed for a second phase (2018-2020) in November 2017 at the Global Forum plenary meeting held in Yaoundé, Cameroon. With encouraging first results, additional development partners joined the Africa Initiative: the African Union Commission, the African Development Bank Group, the European Union, Norway (Norwegian Agency for Development Cooperation), Switzerland (State Secretariat for Economic Affairs) and the West African Tax Administration Forum. The Africa Initiative is open to all African countries and currently has 32 African member jurisdictions. It is supported by 11 partners and donors. The Africa Initiative members meet every year to take stock of the progress made and reflect on the remaining challenges.

(2) Source:https://www.statista.com/statistics/1120999/gdp-of-african-countries-by-country/